A write-up in the African report by David Whitehouse on 31 July 2020, entitled “Nigeria must jump-start automotive strategy, says Volkswagen” resulted in this write-up. After a careful analysis of the publication I cannot but ask myself whether the Nigerian government is hampering the country’s economic growth and development.

German Chancellor Angela Merkel on her visit to the West Africa region in August 2018, of which Volkswagen signed two memorandums of understanding (MoU) with Ghana and Nigeria respectively to start the Volkswagen assembly in Ghana and Nigeria. Nigeria’s automotive policy is still not signed into law by the government, but Ghana Volkswagen has started vehicle assembly since April 2020 with the projection of producing about 5,000 vehicles annually with the possibility of increasing production capacity in the foreseeable future.

Schaefer, the chairman and managing director of Volkswagen in Sub-Sahara Africa noted that Nigeria’s MoU remains “dormant” and also buttressed that Nigeria’s market size and diversity could provide an opportunity for the country to have 10 large factories. This failure to sign such MoU into law for me can be interpreted as a lack of the political will to move forward with such a viable agreement to fruition, whichSub-Sahara Africa Emerging Market could have a positive impact on Nigeria’s economic growth and development.

As a result, observers see “Nigeria’s loss as Ghana’s gain” as seen in David Hundeyin’s publication on the 16th of December 2019, recognizing that the ease of obtaining operating licenses in Ghana in comparison to Nigeria make doing business in Ghana easier vis-à-vis Nigeria.

Even though the term Nigeria being the “Giant of Africa” is becoming a myth, there is also the notion that the Nigerian government’s investment, trade, and travel positions are likened to countries relying on its old greatness but lack modern ideas and vision as explained by David Hundeyin.

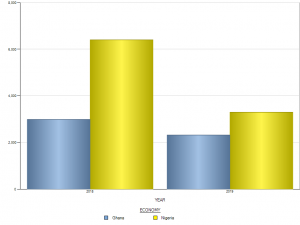

A careful look at the growing economic trend in West Africa subregion, Ghana has become preferred foreign investors and travel destinations in comparison with Nigeria. This can be observed in the UNCTAD 2020 World Investment Report of which Nigeria FDI inflows decrease sharply from $6.4 bn in 2018 to $3.3bn in 2019 showing a decrease of 48.5% compared to the previous year. Although, Ghana in the same period recorded a decrease in its FDI inflows from $3bn in 2018 to $2.3bn in the same period, even though, Nigeria’s population is six times larger than that of Ghana.

Cheap hotels and accommodation

Comparison of Nigerian and Ghana FDI inflows 2018_2019

One cannot but wonder why this sharp decline in Nigeria’s FDI inflows. This can only be understood through the economic prism or policy of both countries. While the Nigerian economic policy is based on the idea of an inward-looking self-sufficient giant. Such protectionist economic policy strategy seems to discourage foreign investors and experts, amidst the country’s increase National debt, poverty, corruption, decreasing citizens’ purchasing power and austerity measures are some of the obstacles hampering Nigeria’s economic growth. Some believe that Nigeria’s hostile regulatory environment, insecurity, and lawlessness are driving factors for the lack of foreign investors’ investment interest in the country.

Ghana, on the other hand, has adopted an open economic policy and sees itself as opposed to Nigeria’s self-aggrandizing “giant of Africa” inviting foreign investors and visitors more than ever before. For instance, lures and encourage the African diaspora to visit or relocate to Ghana are believed to have a positive impact on its trade and investment results. Ghana tourism is now ranked number one in West Africa in terms of its revenue, while Ghana opens its borders Nigeria closes theirs.

Nigeria’s large market of about 200m population should make it a foreign investor’s preferred destination coupled with the country large repertoire of Diasporas. As Nigeria start to turn inward and withdraw from the global investment table. Ghana has taken steps to position itself as a beneficiary of such Nigeria withdrawal and has quietly strengthened its open investment and economic policies, such that Nissan and Toyota are considering starting vehicle assembly in Ghana.

This therefore once again brings me back to the question of whether the Nigerian Government is hampering Nigeria’s economic growth and development? As noted by David Whitehouse, Ghana has a “clear strategy and vision” and took steps to put appropriate key business policies in place and coupled with Ghana’s President’s will to achieve economic success. In that sense, Nigeria’s investment loss is now Ghana’s investment gain, and this should be a lesson for the Nigerian government.

Recent Comments